VerPay – Say it to pay it

A safe payment process for customers who are reluctant to share card details over the phone and don’t want the hassle of EFT payments. Remove any ambiguity from verbal transactions thanks to VerPay’s unalterable and transparent Terms and Conditions for such transactions. You will not receive any client card details when using VerPay, which means you will save the costs of PCI compliance and avoid liability for employee card fraud.

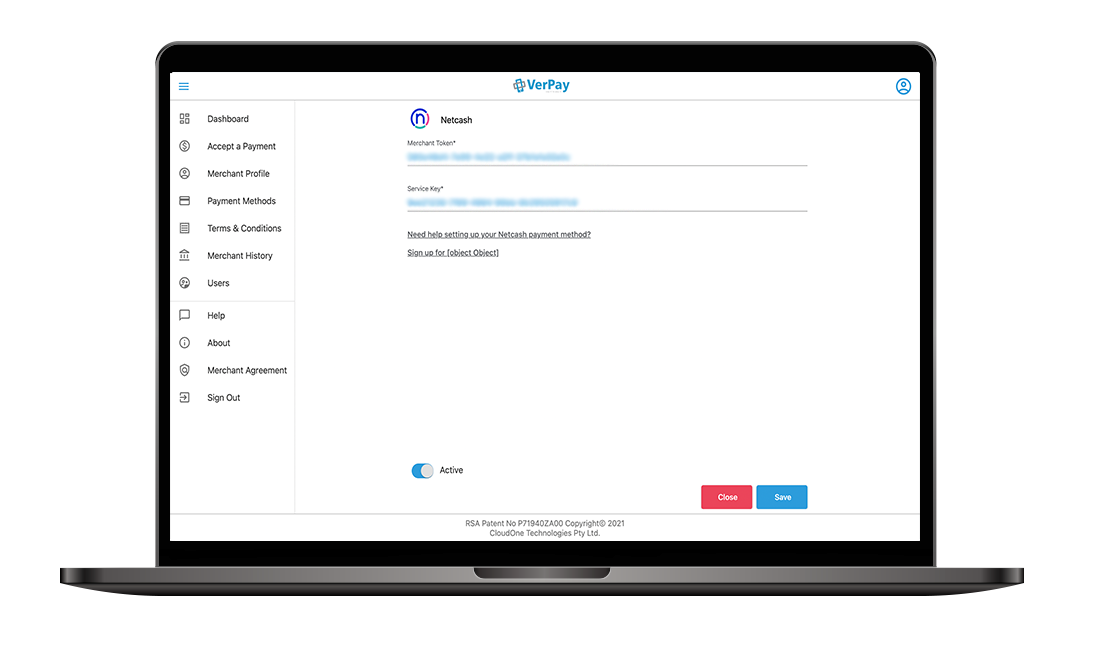

Netcash integration

Through our partnership with Netcash, a single QR Code can be scanned on the VerPay platform, thereby giving the client more options and making it easier to Scan to Pay.

Key features

Easy and secure payment process

Transactions can be completed within a few minutes.

Cloud benefits

Cloud computing is affordable, flexible, remote-controlled, secure and collaborative. It also takes care of security back-ups, software updates and integration.

Uneditable terms and conditions

You don’t share your card details with VerPay or the merchant. You review the merchant’s terms and conditions (e.g. cancellations or returns) before you pay.

Affordable pricing

The VerPay App for Merchants includes the first 100 transactions per month, with no percentage fees on transactions thereafter. There is a US$0.05 fee per successful payment once the 100 free payments have been completed. The merchant may enable a number of user accounts at no extra charge.

Control over payments

Increase your profits by taking charge of your orders and deliveries: manage your own orders and deliveries and save the big commissions charged by third parties.

QR payments

Through our partnership with Netcash, our single QR Code can be scanned with a number of different QR Apps, giving the client more options and making it easier to Scan to Pay.

Alternative Payments

No matter how your customer would like to pay for their desired item, our integrated system will be able to process the payment quickly and easily.

Automated Reconciliation

Netcash Statement Integration saves time reconciling transactions and gives you transaction information immediately, so you can see the takings, the transactions done, etc.

Integrated to:

The history of VerPay

Co-Founder and CEO Dana Buys successfully started and sold a number of software businesses since launching his first business while studying at the University of Cape Town in the early 1980s. Subsequently, a hospitality business owner, among other interests, became frustrated with poor levels of technology, particularly related to Fintech. While visiting his daughter overseas he noticed that it was very hard to make bookings over the phone without giving out your credit card details. VerPay was developed as a safer and more secure alternative.

Benefits of using an integrated Billing solution:

Issue an invoice for easy online payment

Issue an invoice for easy online payment

Send your customers an invoice from your accounting software for immediate online payment. Many of the integrated solutions allow for invoices to have multiple Pay Now payment options on the footer, including a ‘click to pay’ button.

Offer multiple payment options

Offer multiple payment options

Make paying more convenient for your customers so that you get paid quicker. Payment options available include Instant EFT, Bank EFT, Credit Card, Visa Checkout, Cash Payments and QR using major wallets or banking apps.

Automated reconciliation

Automated reconciliation

Easily reconcile your invoice payments to accounting software off a single Netcash statement. Save time, increase accuracy and eliminate the risk of misallocation.