Free up working capital and improve your cash flow

Don’t let cash flow hold your business back. Netcash’s Flexible Business Funding service is a powerful tool that helps you leverage your income in your Netcash account.

Access funds faster, gain greater flexibility to invest in new opportunities, bridge cash flow gaps, and manage unexpected expenses with ease. Focus on what matters most, growing your business with the financial freedom our funding service provides.

Please note that business funding is only available to Netcash clients with a minimum of 6 months' debit order transaction history with Netcash. Netcash does not offer loans.

We offer two funding options:

Advance Settlements

Ideal for short-term needs, this allows you to access funds from a specific debit order batch before its processing date. Advance Settlements are available to Netcash clients using the Debit Order collections service.

Instant Funding

In partnership with Retail Capital, Netcash clients can access business funding to be repaid over a longer term. Instant Funding is available to Netcash clients who have been processing Debit Orders or receiving Pay Now Gateway Payments with us for at least 3 months.

Talk to us about your business funding needs.

Chat to us as a new business, or use your Netcash account to enquire about your funding options.

Advance Settlements

Helping you manage cash flow challenges

Advance Settlements is a convenient solution for accessing funds earlier. No need to wait for processing cycles! You can now unlock the potential of your upcoming debit order collections sooner. Now you can access funds for your authorised debit order batches scheduled for processing within the next 15 days, allowing you to seamlessly manage your cash flow and optimise business operations.

Access your funds earlier

Accessible

Effortlessly access and utilise your advance funds directly within your Netcash account.

Early Access

Unlock the power of early access to your debit order proceeds, boosting your financial flexibility.

Trusted

Deal directly with Netcash, your trusted partner for all your payment needs.

Streamlined Experience

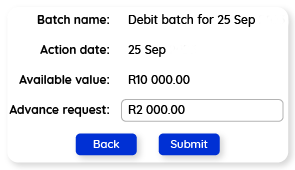

1. Load and authorise your debit order batch.

2. Click on “Request” within the Advance Settlements section.

3. Enter the desired advance amount.

4. Click “Submit” to complete your request.

Unlock the power of Advance Settlements for your business

Chat to us as a new business, or use your Netcash account to enquire about your funding options.

Instant Funding

Netcash and Retail Capital have partnered to bring you Instant Funding.

The flexibility of an Instant Funding offer is in your hands. You can decide on what amount is required as well as the payment term best suited to your business.

By accepting your Instant Funding offer, you agree to the funds being paid into your Netcash account.

To qualify for Instant Funding, you would need to:

Be a Netcash client of at least 6 months

Use your Debit Order Collections and Payment Gateway services

Generate a minimum turnover of R5,000 per month for that same period

Flexible Funding for your business

Unsecured

No security or collateral required.

Flexible

Payment structures tailored to match your business turnover and cash flow cycles.

Secure

With compliance embedded in our business, we keep your data protected, safe and encrypted.

Effortless Application Process

1. Select the required amount.

2. Choose the payment term.

3. View your payment details.

4. Submit your application.

Retail Capital, your trusted partner in SME funding

Over the past decade, Retail Capital have partnered with over 70 000 SMEs providing funding of more than R10 billion. As the market leaders in business funding, they has provided the industry with innovative, flexible, and convenient alternatives to traditional loans. Visit their website to find out more: www.retailcapital.co.za.

Business is the lifeblood of the economy and Small and Medium Businesses are the Growth Engine for the future, employing the most people and growing faster than Large Businesses. It is vital they have the resources and the skills to grow. At Retail Capital, we partner to provide funding and support services to benefit South Africa.

Unlock your cash flow today

Chat to us as a new business, or use your Netcash account to enquire about your funding options.